san francisco gross receipts tax estimated payments

Gross Receipts Tax otherwise due on April 30 2020 are deferred for taxpayers with San Francisco gross receipts of 10 million or less measured using calendar year 2019 gross. Estimated SF Gross Receipts The.

Taxes Salary In San Francisco Ca Comparably

For registration years after June 30 2015 annual fees are determined by gross receipts from the.

. The fees range from 15000 to 35000 for companies with payroll expenses over 20M. Use this TTX worksheet to help calculate your gross receipts tax for tax planning and installment payment purposes. Payroll Expense Tax Until 2018 all businesses with a.

Measure E will phase out the citys current payroll tax over a period of five years and replace it with a gross receipts tax. You are being redirected. HRGT imposed additional business taxes to create a dedicated fund to support services for homeless people and prevent homelessness including one tax of 0175 to 069.

The rate would vary based on industry with an average. Article 12-A of the San Francisco Business and Tax Regulations Code provides rules for determining San Francisco payroll expense. Proposition C would create a gross receipts tax on companies with more than 50 million in sales within San Francisco.

San Francisco Online Bill Payment. Business Tax and Fee Payment Portal. Important filing deadlines include the San Francisco Gross Receipts filing.

Welcome to the San Francisco Office of the Treasurer Tax Collectors Business Tax and Fee Payment. It is estimated that this will result in 285 million more. If the proposed tax was.

In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date. Account for 3 of Gross Receipts tax payers pay 57 of all business tax revenue including the Gross Receipts tax Payroll Expense tax and Administrative Office Tax.

Annual Business Tax Returns 2021 Treasurer Tax Collector

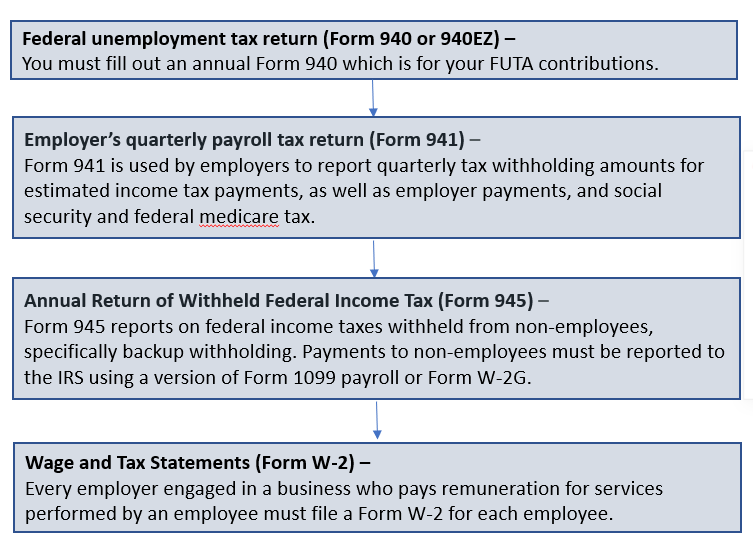

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

San Francisco S Overpaid Ceo Tax Measure Targets Disparity Calmatters

18 How To Write Up A Contract For Payment Free To Edit Download Print Cocodoc

B2b Lead Generation Tools Tactics Examples 2021 Guide

Philadelphia Amend Regulations Relating To Estimated Tax Payment Procedure Chamberlain Hrdlicka Attorneys At Law Mid Market Multi Service Law Firm With Nationally Leading Tax Lawyers

Apple Payments On Iphone Won T Threaten Square Protocol

California Paycheck Calculator Smartasset

Covid 19 Response Treasurer Tax Collector

What Is The Take Home Salary For 100 000 In California Quora